When Will UK Challenger Banks Go Corporate?

When will Challenger Banking muscle start flexing within the Corporate and Institutional space in the UK?

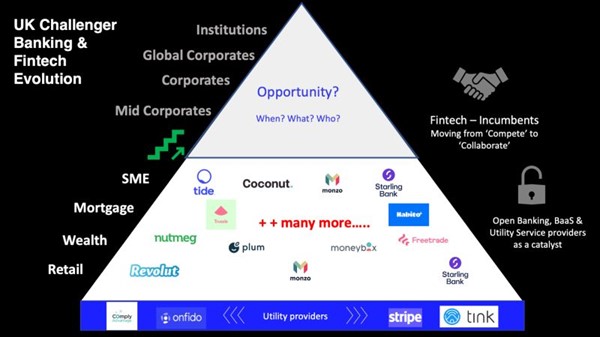

Since 2015, with the dawn of Fintechs, we have witnessed hives of activity in the high-volume customer segments.

Around 80 in the retail, wealth, mortgage and SME space so far and we have around 15M+ customers across this space.

However most have not moved their salary to these accounts. Many just use it as a wallet and maintain their main bank accounts with one of the incumbents.

Is it the Trust, scale and channel capability of incumbents that continues to remain a differentiator?

So what’s next – Can we see more within these segments? More entrants? More innovation? Further extension of services being provided?

And what about the segments beyond Retail, Wealth and SME that have not yet been tapped by these players? The Corporates and beyond.

Can we expect to see new players provide services for Mid corps next?

Surely a more complex sector to play within, but the opportunity exists and is it fair to say that the next few years will see existing or new players get active in this space?

And yes, we have more accelerators now than we did few years ago.

For example - We now have a matured range of innovative utility providers, for customer onboarding, KYC, payments etc, who are essentially service providers to challenger banks, Fintechs and incumbent banks.

These can help accelerate the process.

So, will we see challenger banks compete with the large banks, considering the scale, trust and stake that exists with corporates and beyond? Or is it more likely that they will continue to increase collaboration instead and innovate together within these larger customer segments?

Comments

No comments yet. Be the first to comment!