D-SAFE: Reshaping Renewable Energy Investment

D-Safe, or Development Simple Agreement for Future Equity, is a financing instrument designed to simplify raising capital for early-stage startups. It is structurally modeled after the SAFE (Simple Agreement for Future Equity) introduced by Y Combinator, which has gained popularity due to its straightforward nature and efficiency in facilitating investments without the complexities of traditional equity financing.

Key Features of D-Safe

Simplicity: Like the SAFE, a D-Safe is designed to be relatively simple and easy to understand, avoiding the legal complexities often associated with traditional equity financing.

Future Equity: A D-Safe allows investors to provide capital in exchange for the right to receive equity in the company at a future date, typically when the company raises its next round of financing.

No Immediate Valuation: The D-Safe does not require a company valuation at the time of investment. Instead, it defers this valuation to a future financing event, which can simplify negotiations and speed up the process.

Conversion Terms: D-Safe agreements often include specific terms regarding how the investment converts into equity. This can include a discount on the share price in the next round or a valuation cap, similar to the terms found in SAFEs.

Flexibility: D-Safes can be tailored to the needs of the startup and its investors, allowing for various terms that may benefit both parties.

Structural Similarities to Y Combinator SAFE

Deferred Equity: Both D-Safe and SAFE allow investors to convert their investment into equity at a future date without setting a valuation at the time of investment.

Investor Protections: Both instruments can include provisions that protect investors, such as discounts on future equity prices or valuation caps, ensuring that early investors are rewarded for taking on additional risk.

Legal Efficiency: Both instruments aim to reduce the legal complexities and costs associated with fundraising, making it easier for startups to secure funding quickly.

Standardization: Like the Y Combinator SAFE, D-Safe agreements can be standardised, making it easier for startups to use them and for investors to understand them.

In summary, D-Safe is a financing tool that mirrors the principles of the Y Combinator SAFE, focusing on simplicity, flexibility, and investor protection while deferring the complexities of valuation and equity conversion to a later stage in the startup's lifecycle.

D-SAFE Investments Suitable for Renewable Energy Projects

D-SAFE (Development Simple Agreement for Future Equity) investments can be particularly suitable for renewable energy projects for several reasons:

Capital Intensity

High Initial Costs: Renewable energy projects like solar farms or wind installations often require significant upfront capital investments. D-SAFE allows project developers to secure necessary funding without immediately diluting ownership or setting a valuation.

Phased Development: Many renewable energy projects are developed in phases, which can benefit from flexible funding structures like D-SAFE that allow for incremental investment as milestones are achieved.

Long Development Cycles

Extended Timelines: Renewable energy projects often have long development timelines due to regulatory approvals, permitting processes, and construction periods. D-SAFE provides a mechanism for investors to support projects over these extended periods without needing immediate equity conversion.

Regulatory and Policy Uncertainty

Market Fluctuations: The renewable energy sector can be subject to changes in government policies, incentives, and market conditions. D-SAFE agreements allow investors to take on some of this uncertainty, as they can convert their investment into equity once the project is more established and the regulatory landscape is clearer.

Attracting Early-Stage Investors

Risk Mitigation: Investors in renewable energy projects may perceive higher risks due to technological, regulatory, and market uncertainties. D-SAFE structures can offer them a more favorable risk-reward profile, allowing for potential future equity at a discount or with a valuation cap.

Aligning Interests: D-SAFE can help align the interests of early-stage investors and project developers, as both parties are invested in the project's success and future growth.

Encouraging Innovation

Support for New Technologies: The renewable energy sector is characterised by rapid technological advancements. D-SAFE investments can encourage innovation by funding startups or projects that might not yet have a proven track record but show promise in developing new renewable energy technologies.

Flexibility in Structuring

Customisable Terms: D-SAFE agreements can be tailored to fit the specific needs of renewable energy projects, allowing for flexible terms that can accommodate the unique financial and operational aspects of different projects.

Facilitating Partnerships

Collaboration Opportunities: D-SAFE can facilitate collaboration between startups and established companies in the renewable energy sector, as it provides a straightforward way for larger companies to invest in innovative projects without the complexities of traditional equity financing.

D-SAFE investments are well-suited for renewable energy projects due to their ability to address the sector's unique challenges, including high capital requirements, long development cycles, and regulatory uncertainties. By providing a flexible and straightforward investment structure, D-SAFE can help attract the necessary funding to drive innovation and growth in the renewable energy landscape.

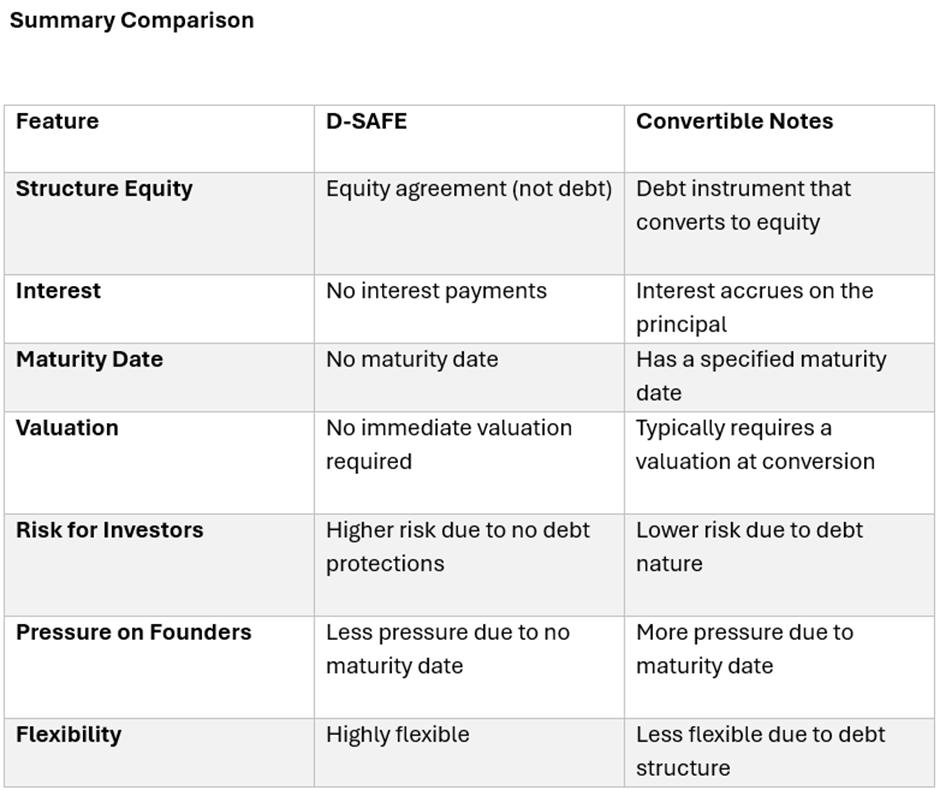

D-SAFE Investments VS Convertible Notes

D-SAFE (Development Simple Agreement for Future Equity) investments and convertible notes are both popular financing instruments used by early-stage companies, including those in the renewable energy sector. Each has its unique features, advantages, and disadvantages for both investors and founders. Below is a comparison of how they work for both parties in the context of renewable energy companies.

D-SAFE (Development Simple Agreement for Future Equity)

Investment Structure: Investors provide capital in exchange for the right to receive equity at a future date, typically during the next qualified financing round.

No Debt: D-SAFE is not a debt instrument; it does not accrue interest or have a maturity date.

Conversion Terms: Investors usually benefit from a discount on the future equity price or a valuation cap, incentivizing early investment.

For Investors

Simplicity: D-SAFE agreements are generally simpler and more straightforward than convertible notes, with fewer legal complexities, making them easier to negotiate.

No Interest Payments: Investors do not receive interest payments, which can be seen as a disadvantage compared to convertible notes.

Equity Upside: Investors have the potential for significant upside if the company grows and succeeds, as they convert their investment into equity at a favorable price.

Risk Mitigation: The structure allows investors to take on risk without immediate dilution, with conversion occurring at a later financing round.

Founders

No Immediate Valuation: Founders can raise capital without needing to determine a valuation, which is beneficial for early-stage companies with uncertain market positions.

Less Pressure: Without a maturity date, founders do not face pressure to repay or convert the investment within a specific timeframe.

Flexibility: D-SAFE agreements can be tailored to meet the specific needs of renewable energy projects, allowing for flexibility in terms of investment conditions.

Convertible Notes

How It Works

Debt Instrument: Convertible notes are essentially short-term debt that converts into equity at a later financing round.

Interest Accrual: Convertible notes typically accrue interest, which is added to the principal amount at the time of conversion.

Maturity Date: Convertible notes have a specified maturity date by which the note must either convert to equity or be repaid.

For Investors

Interest Payments: Investors receive interest on their investment, providing some return even if the company does not perform as expected.

Conversion Benefits: Like D-SAFE, convertible notes often include discounts and valuation caps, giving investors a favorable position in the next financing round.

Debt Protections: As debt instruments, convertible notes can provide more security for investors, especially if the company struggles and the note needs to be repaid.

For Founders

Pressure to Convert or Repay: A maturity date can pressure founders to secure additional financing or repay the note, which can be stressful for early-stage companies.

Debt on Balance Sheet: Convertible notes add debt to the company's balance sheet, which can concern financial health and future funding rounds.

Potential for Dilution: If the company does not perform well, the conversion terms may lead to significant dilution for founders upon conversion.

Both D-SAFE investments and convertible notes have their advantages and disadvantages for renewable energy companies, depending on the specific needs and circumstances of the founders and investors. D-SAFE provides a simpler and more flexible structure without the pressures of debt, making it suitable for early-stage projects. In contrast, convertible notes offer more security for investors through interest and debt protections but come with added pressure on founders due to maturity dates. The choice between the two will depend on the specific goals, risk tolerance, and financial situations of both parties involved.

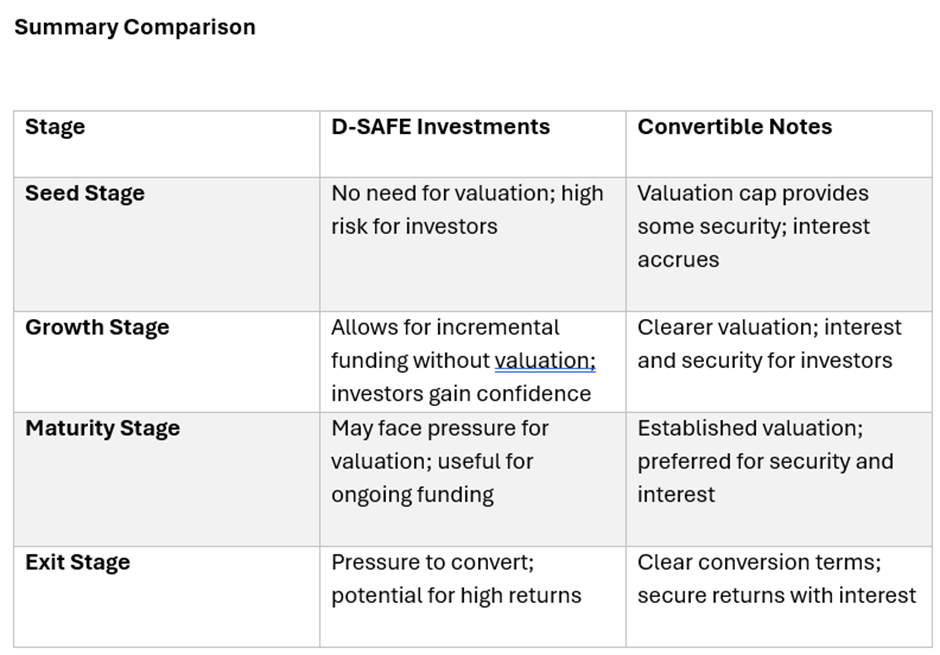

When comparing D-SAFE (Development Simple Agreement for Future Equity) investments and convertible notes in terms of valuation for investors and company founders, it's important to consider how these instruments function at different stages of a renewable energy company's lifecycle. Each stage presents unique challenges and opportunities regarding valuation, fundraising, and financing structure. Here's a breakdown of how D-SAFE and convertible notes compare across various stages:

Seed Stage (Early Development)

D-SAFE Investments

Valuation: D-SAFE allows founders to raise capital without needing to establish a valuation, which can be difficult at this stage given the uncertainty around technology, market fit, and regulatory factors.

Investor Perspective: Investors assume higher risk but receive the potential for equity at a favorable price during future funding rounds. They benefit from discounts or valuation caps without the complexities of immediate valuation negotiations.

Convertible Notes

Valuation: Founders may still struggle to set a valuation; however, convertible notes can include a valuation cap that provides a maximum price at which the note will convert to equity.

Investor Perspective: Investors may feel more secure with a convertible note since it is a debt instrument. They can accrue interest, and the valuation cap allows them to convert favorably while providing some downside protection.

Growth Stage(Development and Scaling)

D-SAFE Investments

Valuation: As the company develops its projects and demonstrates traction, D-SAFE agreements can still be beneficial since they allow for incremental funding without needing a precise upfront valuation.

Investor Perspective: Investors may be more willing to invest as they gain confidence in the company's progress. The potential for conversion at a better valuation later can be attractive, especially if the company has made strides in technology or market penetration.

Convertible Notes

Valuation: At this stage, companies may have a clearer picture of their valuation based on project milestones and early revenues. Investors will likely be more willing to accept a cap that reflects the company’s growth.

Investor Perspective: Investors benefit from the interest accrued and the security of a debt instrument, especially if the company encounters challenges. They can convert their notes into equity at a valuation that reflects the company’s increased valuation.

Maturity Stage (Established Projects and Revenue Generation)

D-SAFE Investments

Valuation: If the company has established projects and a clear revenue model, a D-SAFE can still be useful for raising additional capital without the complexities of a formal valuation process. However, founders might face pressure to define a valuation if they seek larger investments.

Investor Perspective: Investors may be more cautious at this stage; they might seek more traditional equity investments rather than D-SAFE, as the company’s valuation is clearer, and they may want to secure a more defined ownership stake.

Convertible Notes

Valuation: By this stage, the company should have a well-established valuation based on revenue, market position, and project performance. Convertible notes can be structured to reflect this, with caps that align with the company’s growth trajectory.

Investor Perspective: Investors may prefer convertible notes as they provide security through interest payments and the ability to convert at a set valuation. They will likely have a clearer understanding of the company's risk profile and growth potential.

Exit Stage (Mergers, Acquisitions, or IPOs)

D-SAFE Investments

Valuation: If a D-SAFE investment has not yet been converted, the company may still negotiate its final valuation based on exit opportunities. There may be pressure to convert to equity ahead of an exit event.

Investor Perspective: Investors holding D-SAFE agreements may benefit from the exit but must convert to equity to realize any gains. If the company is successful, this can lead to substantial returns.

Convertible Notes

Valuation: If the company approaches an exit, the valuation will be clearer, and investors will convert their notes into equity based on the agreed-upon terms, including any valuation caps.

Investor Perspective: Investors are likely to feel secure in their investment, having accrued interest and having a clear path to equity conversion. In the case of a successful exit, they can realize returns based on the established valuation.

Both D-SAFE investments and convertible notes have their respective strengths and weaknesses at different stages of a renewable energy company's lifecycle. D-SAFE is particularly advantageous in the early stages where valuation is uncertain, while convertible notes can provide more security for investors as the company matures.

As the company progresses, the choice between the two will depend on the specific circumstances, including the company's growth, investor appetite, and the overall market environment. Each financing option can be strategically employed based on the company's needs and goals at different developmental stages.

Before a renewable energy company can secure a D-SAFE (Development Simple Agreement for Future Equity) investment, it must complete several pre-project elements to demonstrate its viability and attract potential investors. These elements help establish credibility, reduce investment risk, and provide a clear path forward. Here are the key pre-project elements:

Business Plan Development

Market Analysis: Conduct thorough research on the renewable energy market, including demand, competition, regulatory environment, and potential barriers to entry.

Value Proposition: Clearly articulate the unique value proposition of the company's projects, including how they address market needs and differentiating factors.

Revenue Model: Develop a clear revenue model outlining how the company plans to generate income, including pricing strategies, potential customers, and sales channels.

Feasibility Studies

Technical Feasibility: Assess the technical aspects of the proposed renewable energy projects, including technology selection (e.g., solar, wind, hydro), site suitability, and resource availability.

Economic Feasibility: Analyse the financial aspects of the project, including cost estimates, funding requirements, expected returns on investment (ROI), and payback periods.

Environmental and Social Impact Assessments: Evaluate potential environmental impacts and social implications of the projects, ensuring compliance with regulations and stakeholder engagement.

Regulatory Framework and Permits

Licensing and Permits: Identify necessary permits and licenses required for project development and ensure the company is on track to obtain them.

Regulatory Compliance: Understand and prepare to comply with local, regional, and national regulations related to renewable energy development, including grid connection requirements.

Site Selection and Land Acquisition

Site Evaluation: Conduct assessments to identify suitable sites for renewable energy projects, considering factors such as resource availability, proximity to infrastructure, and environmental considerations.

Land Rights & Agreements: Secure land rights or agreements with landowners for project development, including leases, purchase agreements, or partnerships.

Technical Partnerships and Team Development

Partnerships: Establish relationships with technology providers, engineering firms, and other relevant stakeholders who can assist with project development and implementation.

Team Building: Assemble a skilled management team with experience in renewable energy, project management, finance, and regulatory compliance.

Initial Funding and Financial Projections

Seed Funding: Secure initial funding to cover early development costs, such as feasibility studies, legal fees, and preliminary site assessments.

Financial Modelling: Create detailed financial projections that outline expected costs, revenues, and cash flows over the project's lifecycle.

Risk Assessment and Mitigation Strategies

Risk Analyses: Identify potential risks (financial, technical, regulatory, environmental) associated with the project and develop strategies to mitigate these risks.

Contingency Planning: Prepare contingency plans for potential setbacks or challenges that may arise during project development.

Market Entry Strategy

Go-to-Market Plan: Develop a strategy for how the company will enter the market, including marketing, sales, and distribution plans.

Stakeholder Engagement: Identify key stakeholders (e.g., customers, regulators, local communities) and develop a plan for engaging them throughout the project lifecycle.

Completing these pre-project elements is crucial for a renewable energy company seeking D-SAFE investment. They help demonstrate to potential investors that the company has a well-thought-out plan, a clear understanding of the market and regulatory environment, and a strong foundation for successful project development. By addressing these elements, the company can better position itself to attract investment and move forward with its renewable energy projects.

D-SAFE (Development Simple Agreement for Future Equity) investments are structured to provide a straightforward and efficient way for investors to support early-stage companies, particularly in sectors like renewable energy. Here’s how D-SAFE investments can be effectively structured legally for investors, along with considerations regarding project-specific investments and secondary markets:

Legal Structure of D-SAFE Investments

Agreement Terms

The D-SAFE is a contractual agreement that outlines the terms under which an investor provides funding in exchange for the right to receive equity in the company at a future date, typically during a qualified financing round or other triggering events (e.g., initial public offering (IPO), acquisition).

Key terms include the valuation cap, discount rate, and any specific conditions that must be met before the conversion to equity occurs.

Conversion Mechanism

D-SAFE agreements typically specify how and when the investment converts into equity. This may involve a valuation cap that limits the price at which the investment converts, providing an incentive for early investors.

Investor Rights

Investors usually have rights related to information, voting, and participation in future financing rounds, depending on the terms negotiated in the D-SAFE.

Project-Specific Investments

Directing Investment to Projects

While D-SAFE investments are generally structured at the company level, it is possible to create a variation of the D-SAFE that specifies the use of funds for a particular project. This can be outlined in the agreement, indicating that the investor's funds are to be used specifically for a designated renewable energy project.

However, this structure may complicate the investment, as it requires clear tracking and reporting of how funds are utilized. It can also raise issues related to project risk versus company-wide risk, as the success of the investment would then be tied to the performance of a specific project rather than the overall company.

Secondary Market for D-SAFE Investments

Liquidity Considerations

D-SAFE investments are generally illiquid until they convert into equity during a subsequent financing round or exit event (like an IPO or acquisition).

However, some companies and platforms have begun to explore secondary markets for early-stage investments, allowing investors to buy and sell their D-SAFE agreements before conversion. This can provide liquidity but may also involve legal and regulatory complexities.

Transferability

The ability to transfer D-SAFE investments may depend on the specific terms of the agreement. Some D-SAFE agreements may include clauses that allow for transferability, while others may restrict it.

Investors should carefully review the terms regarding transferability and any potential secondary market platforms that facilitate these transactions.

Regulatory Considerations

The sale of D-SAFE agreements in a secondary market may be subject to securities regulation, including registration requirements or exemptions, depending on the jurisdiction and the nature of the investors (accredited vs. non-accredited).

Compliance with securities laws is crucial to ensure that any secondary market transactions are conducted legally.

D-SAFE investments can be structured effectively for investors through clear contractual terms, conversion mechanisms, and investor rights. While directing investment to a specific project is possible, it adds complexity and requires careful consideration of project risks. The development of a secondary market for D-SAFE investments is an emerging area that provides potential liquidity for investors, but it comes with regulatory and transferability considerations that must be carefully navigated. Investors should seek legal advice and conduct thorough due diligence when considering D-SAFE investments and any secondary market opportunities.

D-SAFE Investments has become a very good structure that enables investors to allocate capital to renewable energy companies in a risk adjusted and legal way at a crucial time in the company’s lifecycle.

Frequently Asked Questions

Q1. Could you start by giving us a brief overview of your professional background, particularly focusing on your expertise in the industry?

I have over 20 years of experience in the private and public equity sectors focused on energy and natural resources. My company provides initial technical services, feasibility studies, project management, structuring finance for the project, and with investors to reduce risk and manage returns.

Q2. What is the competitive positioning of D-SAFE-backed companies compared to those funded through traditional equity or green bonds?

D-SAFE companies have the following advantages:

Lower Transaction

Blockchain technology's efficiency lowers transaction costs. Process automation through smart contracts can also reduce administrative and operational expenses.

Accessibility

D-SAFE companies can use tokenization, allowing fractional ownership and making it easier for a broader range of investors to participate. This opens investment opportunities to retail investors who may not meet the high thresholds typically required for traditional investments.

Blockchain Technology

The use of blockchain technology can enhance liquidity through secondary markets for tokenized assets. Investors may be able to trade their holdings more easily compared to traditional equity, especially if the tokens are listed on exchanges.

Regulatory Compliance

D-SAFE Companies must navigate the evolving regulatory landscape governing digital securities. While this can be complex, many D-SAFE platforms are built with compliance features in mind, potentially making it easier to adhere to regulations.

Investor Engagement

D-SAFE Companies often leverage technology to enhance investor engagement through real-time updates, access to data, and community involvement. This can foster a stronger relationship between companies and their investors.

Speed of Capital Raising

Issuing tokens can be faster than traditional fundraising methods, allowing companies to access capital more quickly and efficiently.

Fundraising can be lengthy in Traditional Equity/Green Bonds due to due diligence, regulatory approvals, and market conditions.

Q3. Are there specific blockchain platforms or protocols emerging as leaders in enabling tokenized D-SAFE instruments?

Yes, several blockchain platforms and protocols are emerging as leaders in enabling tokenized D-SAFE (Digital Securities and Financial Instruments) instruments standards. Here are some notable ones:

Ethereum: As one of the most widely used blockchain platforms, Ethereum supports the creation of smart contracts and decentralized applications (dApps). Its ERC-20 and ERC-721 token standards are commonly used for creating fungible and non-fungible tokens (NFTs), respectively, making it a popular choice for tokenized securities.

Polymath: Polymath is specifically designed to create and manage security tokens. It provides a platform that simplifies the process of launching tokenized securities while ensuring compliance with regulatory requirements.

Tezos: Tezos is known for its on-chain governance and formal verification capabilities, which can enhance the security and compliance of tokenized financial instruments. It supports smart contracts and has been adopted by various projects focused on tokenized assets.

Stellar: Stellar is designed for cross-border transactions and has features that make it suitable for issuing and transferring tokenized assets. Its focus on financial inclusion and low transaction fees makes it appealing for tokenized financial instruments.

These platforms are leveraging the benefits of blockchain technology, such as transparency, security, and efficiency, to facilitate the growth of tokenized D-SAFE instruments. As the regulatory landscape evolves, we can expect further developments and innovations in this space.

Q4. What innovative valuation cap and discount mechanisms are being applied in D-SAFE agreements to balance investor risks and reward?

In D-SAFE (Digital Securities and Financial Instruments) agreements, innovative valuation cap and discount mechanisms are employed to balance investor risks and rewards effectively. These mechanisms aim to provide attractive terms for investors while ensuring that companies can raise capital without excessively diluting their ownership. Here are some of the key approaches being utilized:

Valuation Cap: A valuation cap sets a maximum valuation at which an investor's investment converts into equity. This protects early investors from excessive dilution if the company’s valuation rises significantly before the conversion occurs.

Discount Rate: A discount rate provides early investors with a percentage discount on the price per share in a future financing round compared to new investors. This serves as an incentive for taking early-stage risks.

Hybrid Structures: Some D-SAFE agreements combine both valuation caps and discounts to provide multiple layers of protection and incentives for investors.

Performance-based Caps: In this structure, the valuation cap may adjust based on the company’s performance metrics, such as revenue milestones or user growth.

Time-based Discounts: Discounts can be structured to decrease over time, rewarding early investors more significantly than those who invest later.

Token-based Incentives: Some D-SAFE agreements may incorporate additional token-based rewards for early investors, such as governance tokens or bonus tokens that provide additional value or utility.

Investor Protections: Some D-SAFE agreements may include protective provisions that allow investors to convert their investment under certain favorable conditions, such as a change of control or acquisition.

Q5. What types of renewable energy technologies (for example energy storage, floating solar, tidal power) are most likely to benefit from D-SAFE financing in the next 2-3 years?

The renewable energy technologies most likely to benefit from D-SAFE financing are:

Advanced Recycling: The demand for sophisticated solutions for using polyolefins from fossil fuels continues to increase. Technologies that can chemically facilitate plastic-to-plastic and plastic-to-fuel in conjunction with petrochemical companies continue to increase in demand. D-SAFE investments are most suitable for the companies and investors before production.

Energy Storage Systems: As renewable energy sources like solar and wind are intermittent, Energy Storage Systems (ESS) are crucial for balancing supply and demand. These are technologies like Lithium-ion batteries, flow batteries, and emerging technologies such as solid-state batteries and hydrogen storage.

Tidal and Wave Energy: Tidal and wave energy technologies harness the energy from ocean currents and waves to generate electricity. These technologies include tidal turbines, oscillating water columns, and point absorbers. They are still emerging, and D-SAFE financing can provide the necessary capital for research, development, and deployment, attracting investors interested in innovative marine energy solutions.

Offshore Wind Energy: Offshore wind farms are increasingly being deployed to harness stronger and more consistent wind resources. D-SAFE financing can support financing structures for large-scale offshore projects, including the development of floating wind turbines, which are suitable for deeper waters and can expand the geographical reach of wind energy.

Hydrogen Production Technologies: Green hydrogen production through electrolysis using renewable energy sources is gaining traction as a clean energy carrier. D-SAFE financing can facilitate investments in hydrogen production facilities, storage solutions, and distribution networks, appealing to investors focused on the hydrogen economy.

Smart Grid Technologies: Smart grids enhance the efficiency and reliability of electricity distribution by integrating advanced technologies and renewable energy sources. D-SAFE financing can support the deployment of smart grid infrastructure, including energy management systems, demand response technologies, and decentralized energy solutions, enabling more effective integration of renewable energy.

Q6. How are secondary markets for D-SAFE agreements developing, and what challenges exist in creating liquidity for these instruments?

Current development of secondary markets for D-SAFE agreements:

Increased Interest in Digital Assets: The rise of blockchain technology and digital finance has led to increased interest in tokenized assets, including D-SAFE agreements. This interest is fostering the development of platforms that facilitate trading and liquidity.

Institutional Participation: Institutional investors are increasingly exploring digital assets, including D-SAFE agreements, which can help provide liquidity. Their participation can also lend legitimacy to the market.

Integration with Traditional Markets: Efforts are underway to integrate D-SAFE agreements with traditional financial markets. This integration can enhance liquidity by providing access to a broader range of investors and trading mechanisms.

Regulatory Uncertainty: While regulatory frameworks are evolving, uncertainty remains in many jurisdictions regarding the classification and treatment of digital securities. This uncertainty can deter potential investors and hinder market participation.

Technical Barriers: The technology underlying D-SAFE agreements, such as blockchain, may present technical challenges for some investors. Issues related to wallet management, security, and the need for digital literacy can limit participation.

Comments

No comments yet. Be the first to comment!