COVID19 And Business Continuity: NBFC/MFI

COVID19 has brought unprecedented times that have never been seen before and all business continuity strategies failed as none accounted for work from home as an option. Businesses who have been proactively working on using the latest technologies for normal operations and extensively using digital technologies are relatively less impacted by the COVID19 effect.

Business Continuity

The adoption of technology and migrating from man to machine is the success mantra now. A need of the hour is also to have well planned and regularly tested disaster recovery and business continuity policy. With work from home now going to be here, it is also extremely important to have robust data security policies in place to prevent organisation from hacking/ransomware attacks/malware etc.

Public clouds will play a major role in enabling organisations to focus more on their core areas and with technology management left to experts to deal with. All business-critical applications and mailing systems should be on the cloud and real-time replication to DR site. Access to these applications should be restricted and only permitted to authorized users after multi-level user authentication.

The organisations whose setups are running on cloud faced little challenges during this COVID19 lockdown and the only thing that was required was a laptop for all employees and a few additional security measures to protect company information.

Easing Payment Routes for Customers

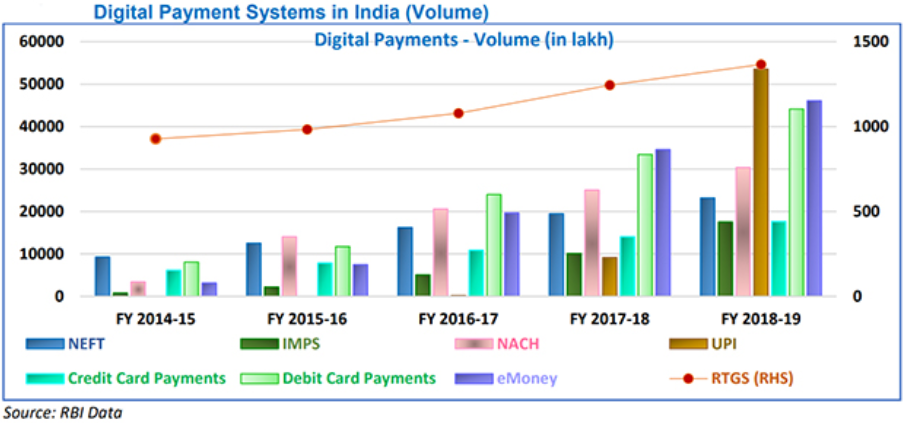

Since the lockdown, customers could not visit the branches to deposit the payments/EMI/interest. Most of the MFIs in India still work on cash collection mode and this has seriously impacted their ability to survive in these COVID19 lockdown times.

The majority of these small to mid-size organisations have no provision even to collect payment through digital channels even if a set of customers are willing to make payment using the same. The need of the hour is to quickly enable digital channels of accepting payments and provide alternatives to customers to repay the money and at the same time keeping the safety and security of employees in consideration and following strict lockdown guidelines.

This will ensure that the operations and accounts team continue to work even in these difficult times and could contribute towards the revenue of the company.

In a span of 48 hours, organisation can be on-boarded and enabled wherein customers using any online payment mode like wallets, UPI, credit card, debit card, net banking etc., they could pay their outstanding amount. There will be all required checks in the system to verify the user through OTP etc before he can make payments.

However, integration time for a more customised platform wherein digital payment setup is tightly integrated with organisation lending/collection system may take time depending upon whether the organisation has an in-house development team or dependent upon partners for integration and development.

Going forward the organisations need to plan to invest more towards cyber-security and automation systems. We are already seeing in the spurt of cases related to security incidents. Mobile Apps are most vulnerable unless properly secured.

Comments

No comments yet. Be the first to comment!